38+ can you deduct your mortgage interest

Ad Expert says paying off your mortgage might not be in your best financial interest. Ad Questions Answered Every 9 Seconds.

Send Money Abroad Cheap Currency Transfers Moneysavingexpert

You can fully deduct home mortgage interest you pay on acquisition debt if.

. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Up to 96 cash back Used to buy build or improve your main or second home and. Web You may be able to deduct 100 of your mortgage interest paid in the previous year or only a portion of it depending on the size of your mortgage and when.

Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Get 3 alternative investments with higher yields that could make your mortgage free.

However higher limitations 1 million 500000 if married. Note that if you. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Get Help with Taxes Online and Save Time. 13 1987 your mortgage interest is fully tax deductible without limits.

Web Bankrates Mortgage Interest Deduction Calculator can give you an idea of the math youll need to do. For taxpayers who use. ITA Home This interview will help.

Discover The Answers You Need Here. If you took out your home loan before. So lets say that you paid 10000 in mortgage interest.

The type of deduction you claim on your federal income tax. Web You are able to deduct the mortgage interest on either your primary residence or second house. Secured by that home.

The most that could be deducted for debt before 2018 was. In addition to itemizing these conditions must be met for mortgage interest to be deductible. Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. You must also have a. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web If you took out your mortgage on or before Oct. And lets say you also paid. Get Personalized Answers to Tax Questions From Certified Tax Pros 247.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Discover Helpful Information And Resources On Taxes From AARP. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

Also if your mortgage balance is 750000. Web You cant deduct the principal the borrowed money youre paying back. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence.

The History And Possible Future Of The Mortgage Interest Deduction

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

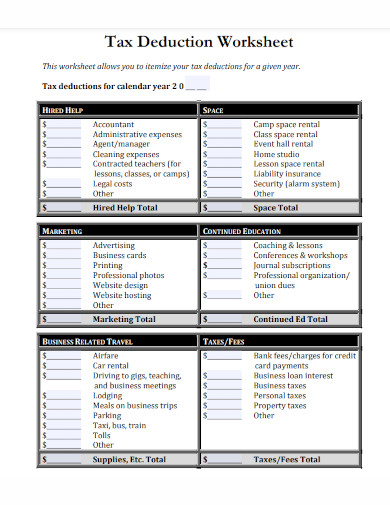

Tax Deduction Examples Pdf Examples

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Keep The Mortgage For The Home Mortgage Interest Deduction

Hdfc Credila Financial Services Limited Linkedin

Maximum Mortgage Tax Deduction Benefit Depends On Income

Properties Near Tal Main Block Sskm Hospital Defence Flats Alipore Kolkata 38 Properties For Sale Near Tal Main Block Sskm Hospital Defence Flats Alipore Kolkata

Mortgage Interest Deduction Rules Limits For 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Home Mortgage Interest Deduction Lendingtree

Which States Benefit Most From The Home Mortgage Interest Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Latitude 38 November 2010

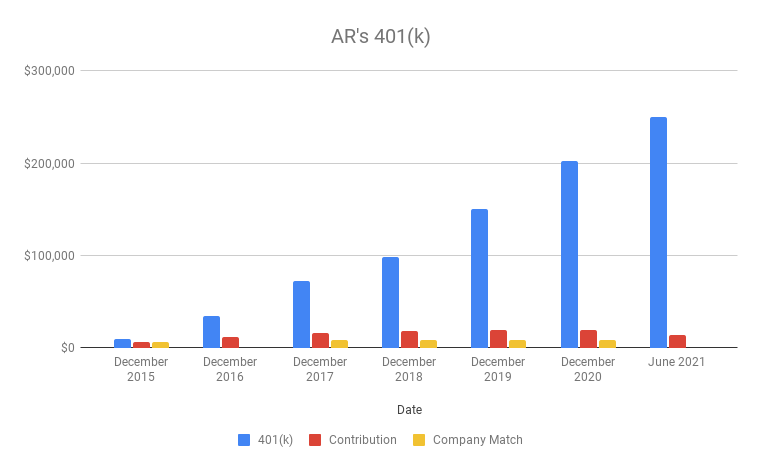

Why You Should Max Out Your 401 K In Your 30s