24+ Permanent life insurance

Permanent life insurance is a type of insurance that protects against the death of a policyholder. Permanent life insurance accumulates cash value over time as you pay your premiums.

Why Is Insurance Not Purchased But It Has To Be Sold Quora

For a quick comparison of the cost of different types of life insurance take a look at some Allstate sample quotes for 250000 in coverage for a healthy individual.

. Permanent life insurance is generally more expensive than term life insurance. See your rate and apply now. Compare Find the Best Policy For You Save.

The Most Reliable Permanent Life Insurance Providers That Have Your Interests At Heart. 1 With the potential for higher returns there is more expenses involved with the policy. In contrast permanent insurance provides lifelong protection.

No Medical Exam - Simple Application. The right life insurance plan from a trusted company can help one get long-term risk cover plus savings ie. In addition permanent insurance also provides living benefitsin the form of cash value.

Ad Find the Top Permanent Life through National Family. As long as you pay the premiums and no loans withdrawals or surrenders are taken the full. Term life is less expensive especially when you buy it early in life.

GVUL combines life insurance protection with tax-deferred investment options. Permanent life insurance and term life insurance both offer financial security to your loved ones when you die but are otherwise very different. It also includes a cash value component which allows you to save money.

Help protect your loved ones with valuable term coverage up to 150000. Most permanent life insurance policies have a cash value account. When it Comes to Protecting Loved Ones New York Life is Here to Help.

Ad Fidelity Life Insurance - Life Insurance You Can Rely On. Once you have a cash value you have the option of tapping into it. Invest additional dollars above the cost of insurance into.

Let them celebrate your life rather than worry about the cost of a funeral. Buy Online or Over the Phone. Buy Online or Over the Phone With Our Expert Agents.

Permanent life insurance is lifelong insurance coverage for those who want more flexibility and a longer policy term some insurance companies cover up to 121 years. The cost of AARP life insurance varies greatly because they offer different policy types. Talk To An Advisor About How A Whole Life Insurance Policy Can Fit Into Your Portfolio.

Dual benefits from one solution. Ad Weve Been True to Our Core Values for 175 Years. Ad See How Whole Life Insurance Can Help Protect Your Family Even Grow In Value Over Time.

As long as you pay your premiums your coverage stays in force. This allows you to. The main benefit of permanent life insurance is that it lasts through the policyholders entire life cycle.

Permanent life insurance stays in place for life starting when your policy takes effect until you pass away. Ad Rates starting at 11 a month. The four main types of permanent life insurance are whole life universal life variable life and variable universal life.

Prepare with guaranteed life insurance from 995. On the other hand term life insurance only lasts for a specific amount of time and is. We Make it Easy to Get Life Insurance.

Over time you can access. Permanent insurance can provide a level premium for the life of the policy. Ad Funerals are expensive.

This is true for both men and women according to our research. Thats because these plans come with added features and benefits beyond what term life offers. Ad Life Insurance You Can Afford.

Talk To An Advisor About How A Whole Life Insurance Policy Can Fit Into Your Portfolio. A 30-year-old woman can expect to pay. Permanent life insurance plans term life insurance rates chart by age permanent life insurance for seniors permanent whole life insurance rates aarp permanent life insurance rates what is.

Whole life is also a permanent life insurance option but not offered by Lincoln Financial Group. With permanent life insurance you dont have to. Call a licensed expert.

What is permanent life insurance. Both term and permanent life insurance provide your family with peace of mind by offering a death benefit but they differ in a few key ways. A healthy nonsmoking 65-year-old male seeking 25000 in coverage will pay a monthly.

Ad See How Whole Life Insurance Can Help Protect Your Family Even Grow In Value Over Time. One option is to. A permanent life insurance policy allows you to invest in an account with a tax advantage which you can borrow from or use during the duration of the policy as well.

Permanent life insurance is designed to last your entire life. Permanent life insurance is a policy that pays a death benefit to your beneficiaries upon your passing. Ad Our Comparison Chart Makes Choosing Simple.

Erie Insurance Review Auto Home And Life Insurance In 12 States

Felicia Kestenberg Founding Partner Kesten Financial Group Linkedin

2

Pricing Truth Concepts

2

2

Explore Our Image Of Monthly Spending Budget Template For Free Budgeting Worksheets Budget Template Worksheet Template

Which State In The Us Provides The Best Insurance Plan For Infertility Treatments Quora

2

Investordaypresentation

Er Nakul Soren Nakul Soren Twitter

31 Video Marketing Strategies And Ideas For Insurance Agents Video Marketing Strategies Insurance Marketing Life Insurance Facts

28 Ways To Get More Insurance Agency Facebook Fans Lifeinsurancetips Insurance Agency Insurance Sales Life Insurance Quotes

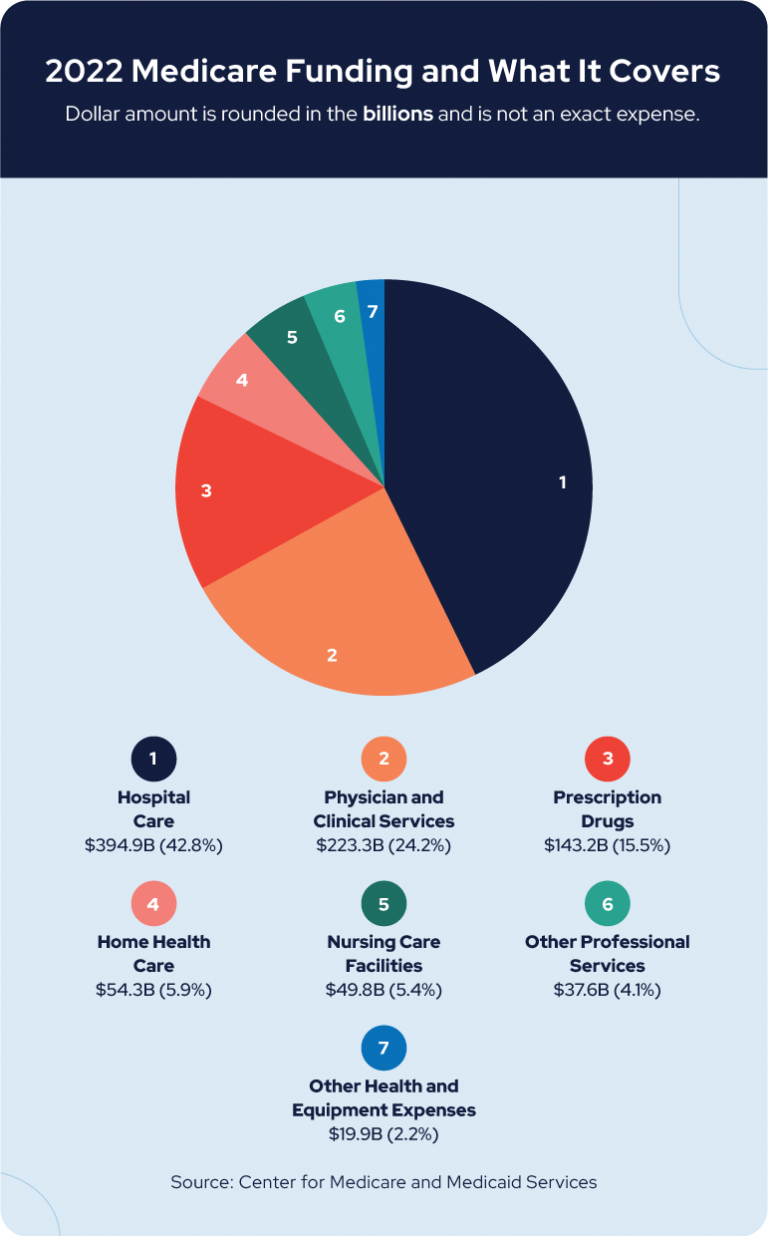

21 Essential Facts About Medicare To Know In 2022

24 Essential Iphone Apps For Insurance Agents Life Insurance Agent Insurance Agent Best Insurance

2

Networking Tips For Insurance Agents 34 Smart Ideas Pet Insurance Pet Insurance Dogs Pet Insuran Life Insurance Facts Insurance Agent Best Health Insurance